06: The Lowest-Risk Way You Would Specialize#

The approach I want you to take to specialization is to default to the lowest-risk option available to you unless some uncommon special circumstances (described later) are true. A specialization can be static, but rarely is. You can update or evolve it over time in response to changes in your business or the market. So after you have successfully specialized, you can add risk by more narrowly specializing or by pursuing a specialization with less certain demand but more potential upside.

Specialization is deciding to focus on serving a single type of client (usually described as an industry, market vertical, or audience), or becoming an expert in a single discipline, platform, language, framework, or tech stack. Reality is complex and messy, so in reality even a narrowly focused specialist will learn about adjacent topics and be asked to consider adjacent work. A specialization is not a monastic vow, but a sustained focus with somewhat fuzzy and permeable edges.

ACTION: Start by creating a shortlist of the ways you might like to specialize. As you create this shortlist, you can use any of the specialization “recipes” in the list below:

Custom software for [industry, market vertical, or audience]

[A specific sub-discipline, like DevOps or security or hundreds of other possibilities] specialist(s)

[A specific sub-discipline, like DevOps or security or hundreds of other possibilities] for [industry, market vertical, or audience]

[A specific platform, language, framework, or tech stack] specialist(s)

[A highly customized and productized service offering that you think could become the pillar of your business]

@TODO: screenshot of typical shortlist

After you’ve created your shortlist, exclude any potential specializations where you lack sufficient credibility (as would be judged by prospective clients).

Order your shortlist based on most to least desirable specializations (from your perspective). What makes a specialization desirable will be different for everybody, but common factors include:

Revenue potential

Lifestyle business potential

Growth (in terms of headcount) potential

Ease of selling the services

Potential to sell the business after building it up

Of course you won’t know with certainty whether a specialization that seems like it has good revenue potential, for example, actually will become a high-revenue business, but go with your best guess as you order your list.

It is possible but unlikely to become bored with a specialization unless it’s very low-value, mechanical work, but there are many such businesses that have scaling or labor arbitrage opportunities, so such a business could be interesting to own and run once you’ve delegated the truly boring work.

Around age 40 is when I see a lot of software people wanting to get off the treadmill of constantly updating their code-level tech skills and move on to architecture, strategy, or team-building work, so factor this pattern into your thinking about what is/isn’t a desirable specialization for you.

I’m going to refer to the idea of a market as I explain how to make sure your potential specialization is sufficiently low risk. I think most of you intuitively understand what a market is, but in case not:

@TODO: definition of a market

To successfully specialize in a low-risk way, there must be a healthy existing market to sell to. A healthy market requires two things: 1) an understood thing to trade and 2) at least some liquidity.

Buyers need to understand the thing they are buying (it has known characteristics and a commonly-used name) or at least believe it has current or future value equal to or greater than the price they are paying.

Ex: Calling yourself a “Software Team Excellence Specialist” is going to require significant explanation of what that even is before you can find buyers for it. This (made up) specialization fails the “understood thing” test. It’s a no-go for low-risk specialization.

Ex: Selling a code audit service and instead of looking at the code you interview 3 developers who wrote it because that’s more profitable for you might be clever, but it also fails the “understood thing” test because calling something a code audit means to 99.999% of buyers that you’ll actually look at the code.

In a market with at least some liquidity, sellers can find full-price buyers sufficiently quickly. The market for shares of Ford motor company is highly liquid[Average daily trading volume: 64.286 million shares; if you want to sell some shares of F, you’re going to find buyers immediately.], while the market for surplus missile silos[This one[wayback link: https://web.archive.org/web/20221214141025/https://www.zillow.com/homedetails/2432-Fair-Rd-Abilene-KS-67410/113177058_zpid/] in Abilene, Kansas took about 2 years and at least one price drop to sell, which actually seems kind of fast, but definitely not the same-day sales that were common at the early-2020’s peak of the US housing market.] is considerably less liquid.

I’m drawing an analogy here between two fundamentally different things (products or identical shares of a company vs. the custom, expensive services that you sell), but the notions of a market and of liquidity are so useful for thinking about low-risk positioning that I’m gonna go with it anyway.

If any of the potential specializations on your shortlist do not have a healthy market to sell to (remember, that’s known thing + liquidity), then they are somewhere between a higher-risk specialization and a no-go. How do you know if a potential specialization has a healthy market for it? You do an hour or two of research using this protocol:

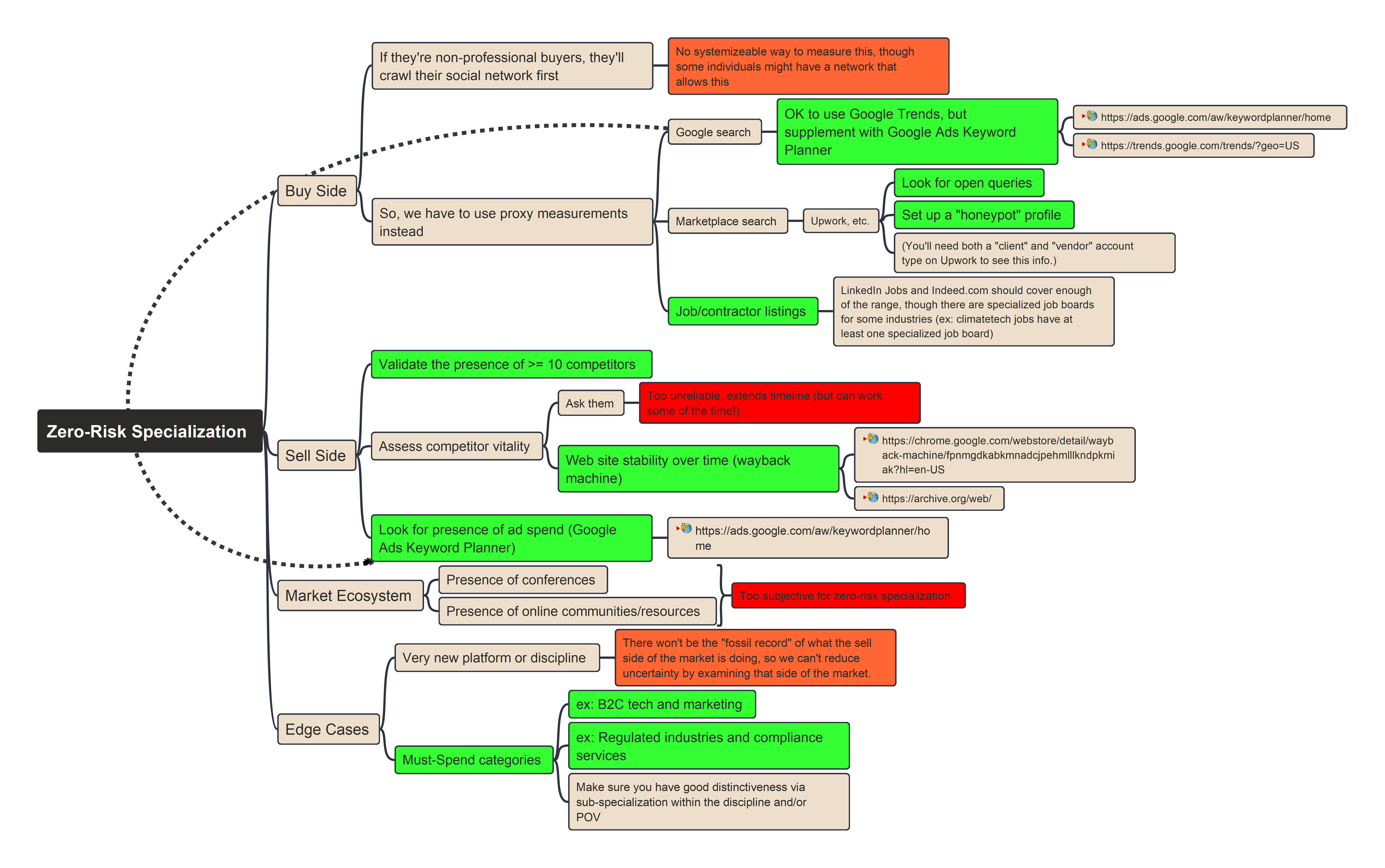

To know if your potential specialization is sufficiently low risk, you need to know if there’s a healthy market to sell to, and a healthy market requires liquidity, and if there’s no liquidity then there will be no sellers in that market (or a few unhealthy sellers). To find out if there’s a market for specialized services, you look for the existence of specialized sellers. An illiquid market for specialized services won’t have any sellers (or at most it will have a few struggling sellers) because if sellers can’t find full-price buyers sufficiently quickly, they’ll go out of business or find another market to trade with.[This is one of the larger reversals in my approach over my years of advising business owners on specialization and positioning. I started out advising those who wanted to specialize to examine the buy side of the market and look for un-met demand, in the way that product companies might use Jobs To Be Done or Customer Development-style research. Over the years, this approach has yielded bad results, lengthy timelines, and excessively risky ideas about specializing. The remedy is to heed the saying “the pioneers get the arrows, the settlers get the land” and look at the sell side of the market. The presence (or absence) of a group of healthy sellers (the “settlers”) summarizes a lot of information about the market’s liquidity into one easily-researched and fairly reliable source of information. I believe almost dogmatically in being buyer-centered in your thinking, but when determining if a market is viable, looking at the sellers rather than the buyers works better.] Our protocol has a way of looking at the sell side of the market, but it also describes 3 other facets of a market.

The Buy Side#

In an ideal world, we would measure the demand for your potential specialization by examining the buy side of the market. That is the source and ultimate determiner of demand for any kind of services.

Most markets for specialized services will have between 100 and 200 times as many buyers as sellers. From a research perspective, this creates a workload problem. Those buyers may be willing to tell you what they have done in the past, but they often cannot accurately predict what they will do in the future when it comes to buying specialized services. This is an insight problem. Finally, getting a representative sample of the buy side of the market to respond to your research is an access problem.

Thus, researching the buy side of the market in order to understand or measure the demand for specialized services is plagued with workload, insight, and access problems. However, there are a few places where the buy side of the market leaves more easily-observed evidence of their demand for specialized services:

Web search activity

Solicitations for specialized services via job postings, RFPs, or contractor/freelancer postings

That’s why looking at web search activity and job/RFP postings is part of our validation protocol.

The Sell Side#

As we know, the mere presence of healthy sellers (potential colleagues/competitors, if you were to specialize in a way similar to them) on the sell side of the market is our best single source of evidence that there exists a health market for specialized services. We can also see some evidence of this market’s health if sellers have paid to place search ads for their services in the past. Google’s Ad Keyword Planner provides this data, and we can use it as a medium-strength piece of evidence in assessing the health of a market.[This is a medium-strength signal, not a strong signal, because running ads as part of selling expensive custom services is not standard for all businesses that sell such services. We don’t want to over-rely on this “others have run ads” signal, which is why I’m stressing that it’s a medium-strength signal about market health.]

Ideally, we could directly ask specialized sellers about the health of their business, but for obvious reasons not all of them would answer such a question honestly or at all, and so when we’re assessing the health of a market by looking at the sell side, we have to examine as best we can their behavior over time, looking for evidence of change or churn in how they describe themselves (which we extrapolate to a dynamic/unstable market or difficulty in finding solution-market fit). We also look for clear evidence of growth (in headcount, etc.). The Internet Archive’s Wayback Machine and LinkedIn are the two most useful tools for gathering this evidence.

The Market Ecosystem#

Another route to understanding a market is to look for signs of vitality and openness in the market ecosystem – the infrastructure of the market itself. This includes things like conferences and online interactions, either ad-hoc or more permanent. We’re seeking a low-risk specialization here, and so I would not recommend trying to understand a market’s health by examining the market ecosystem because it’s too subjective and difficult to interpret.

Edge Cases#

There are two edge cases we should consider. The first – a very new discipline, platform, or market – will have no “fossil record” for us to examine to understand the health of this emerging market. Because we’re pursuing a low-risk specialization, we’ll consider these emerging markets un-viable. Some percentage of the time, that means we’ll miss out on a great specialization. Some much larger percentage of the time, that means we’ll avoid being “pioneers with a collection of arrows in their backs”.

The other edge case is what we’ll call “must-spend categories”. These are specialized services that companies are forced to spend money on, either because a governing body requires it (think regulatory compliance spend), or because market conditions require it (does any established car manufacturer not spend money on advertising; does any B2B software vendor not publish case studies?). Such specializations can have a market that looks weak from the perspective of this research protocol but is actually more robust than it seems. If you have access to buyers and other signals of viability for a must-spend category of specialized services, you can ignore this research protocol.

Executing The Research Protocol#

You’ve got your shortlist of potential specialization options. Starting with the most desirable option on your list, do the following.

ACTION: xxx @NOTE: maybe I disperse this throughout the previous sections that describe the protocol?

(If it’s a must-spend category and you have some form of access to clients there, consider the steps below optional)

Find competitors

Examine their web sites over time

Look for presence of ad spend around likely-buying-intent keywords

See what the Upwork/job landscape looks like

(Very optional because it’s high-effort) If you need more feedback, set up a “honeypot” profile on Upwork

Assess what you’ve learned