07: Higher-Risk Specializations#

If you specialize in any of the 6 ways described below[There are actually just 5 kinds of specialization, but when we incorporate more context we see the 6 risky approaches described here.], you face higher uncertainty about whether your specialization will work well within an acceptable timeframe. Again, if things go badly the extent of the potential harm is 6 to 18 months of crappy financial performance and a bad taste in your mouth about specialization, but probably not “game over” for your business.

1) Category Creation, And The So-Called “Category Of One” Approach, Are Risky#

Category creation is identifying an under-served or emerging need in the market and creating a product or service that fulfills that need in a new, compelling way. To use some examples from the book Play Bigger (which lionizes the idea of category creation), the new category of on-demand transportation (Uber, et al) is profoundly different from the category of taxi cab services and so it stands alone as a separate category, with Uber as its so-called category king. AirBnB is the category king for the on-demand lodging category they created. Another book, Becoming a Category of One: How Extraordinary Companies Transcend Commodity and Defy Comparison, makes a similar argument (published 5 years before Play Bigger[We can trace the idea of category creation even further back to at least 1966 when Eugene Schwartz described something similar in his book Breakthrough Advertising.]).

The notion that you should totalize the idea of specialization and take it to its logical extreme by “becoming a category of one” is an appealing idea. If less competition is good, then no competition must be better! The idea that you could do in your services business what lavishly funded product startups have done is another appealing idea. These ideas can be applied to services business, but the cost of applying them is a large “risk tax”.

First: less competition is not always good, and competition itself has numerous salutary effects. Interacting with your competitors can give you deeper market insight, give you ideas and motivation to help you serve your prospects better, encourage you to develop mutually-beneficial referral relationships, and can lead to unexpected kismet-ey learning. The mere existence of competitors can increase the total supply of opportunity in the market.[For example, when the first CRM software came on the scene, few companies felt they MUST HAVE a CRM. But now that there are like a million CRM options, many (maybe most!) companies think they need a CRM. What caused this increase in demand for CRMs? I think the abundant supply of CRM options at least partly causes companies to think “everybody else has a CRM; we need one too!” Is management consulting or security audits or business storytelling really so different from CRMs?] Strong or even intimidating competitors are good because they encourage you to level up and they help clients thrive, which nurtures the health of the ecosystem you serve. Low-priced competitors are good because they siphon off price-sensitive clients, meaning you are less tempted to join a race to the bottom. Low-priced competitors also do undesirable, crappy implementation work (and they tend to over-serve those clients too), forcing you to find higher value clients that you don’t have to over-serve, which encourages you to do what you should be doing anyway! And the best of your low-priced competitors can become good implementation partners if you focus more on strategy work. If all the participants in a market become locked into a race to the bottom, then yes, competition is not good for the supply side of that market. But in reality, the presence of competition contributes essential variety and vitality to the market.

And yet, using the words “competitor” or “competition” primes us to think in terms of loss rather than gain. We often think of competitors as those who want to take something from us. This is like thinking of a bridge as an opportunity to maybe swerve over the edge and die rather than an opportunity to safely cross the body of water that’s preventing you from getting where you need to go. This is why I lean towards using the idea of market liquidity instead of competition anywhere I can in this book. You’ll remember that liquidity means that a seller can find a full-price buyer quickly enough. This is a good thing, and so is the presence of competition.

Product businesses almost always have a highly scalable production model. The purest example is an app that requires no cloud back-end and is distributed via Apple, Google, or Microsoft’s app store. Whether this app is used by 1 or 1,000,000 users, the same production model moves that app from idea to delivered product. Physical products will have more marginal cost and other friction, but the same idea applies. Services businesses like ours do not have such scalability in the production model. If we do not hire a team, there are limits to how many clients we can work directly with. If we do hire a team, maintaining quality and cost control as the volume of production scales up is a real challenge. Additionally, people cannot acquire deep expertise as quickly as an important new feature can be added to a product. These are the reasons why you cannot directly apply much advice for positioning products to a services business. The advice for product businesses assumes a scalable production model, serious funding, and the malleability of a product.

Category creation is not a bad approach to specialization, just a very risky one. In a bit I’ll describe how to know if you have the “risk budget” to attempt it.

3) A Specialization Where You Have Expertise Or Interest But No Access Is Risky#

In many cases, your expertise + an existing healthy market is enough to successfully specialize. But not always! There are cases where you also need an unusual level of access to buyers.

A few examples to illustrate:

C-level people are your buyers

A relatively closed system like healthcare, which can be inhospitable if you don’t have the right kind of relationships and status

@TODO: 1 or 2 more examples

Access is: one or more sufficiently reliable ways of getting into sales conversations with buyers. Access can range from direct relationships with potential buyers, to a well-connected person who refers those buyers to you, to digital advertising that gets your offer in front of those buyers. Access isn’t necessarily buyers having you on their “speed dial”, it’s merely a repeatable way of getting into sales conversations with buyers.

If your specialization relies on access that you lack, then your expertise + an existing healthy market will not be enough to de-risk it for you.

4) Specializing In A Platform That Has Crossed The Chasm Is Risky#

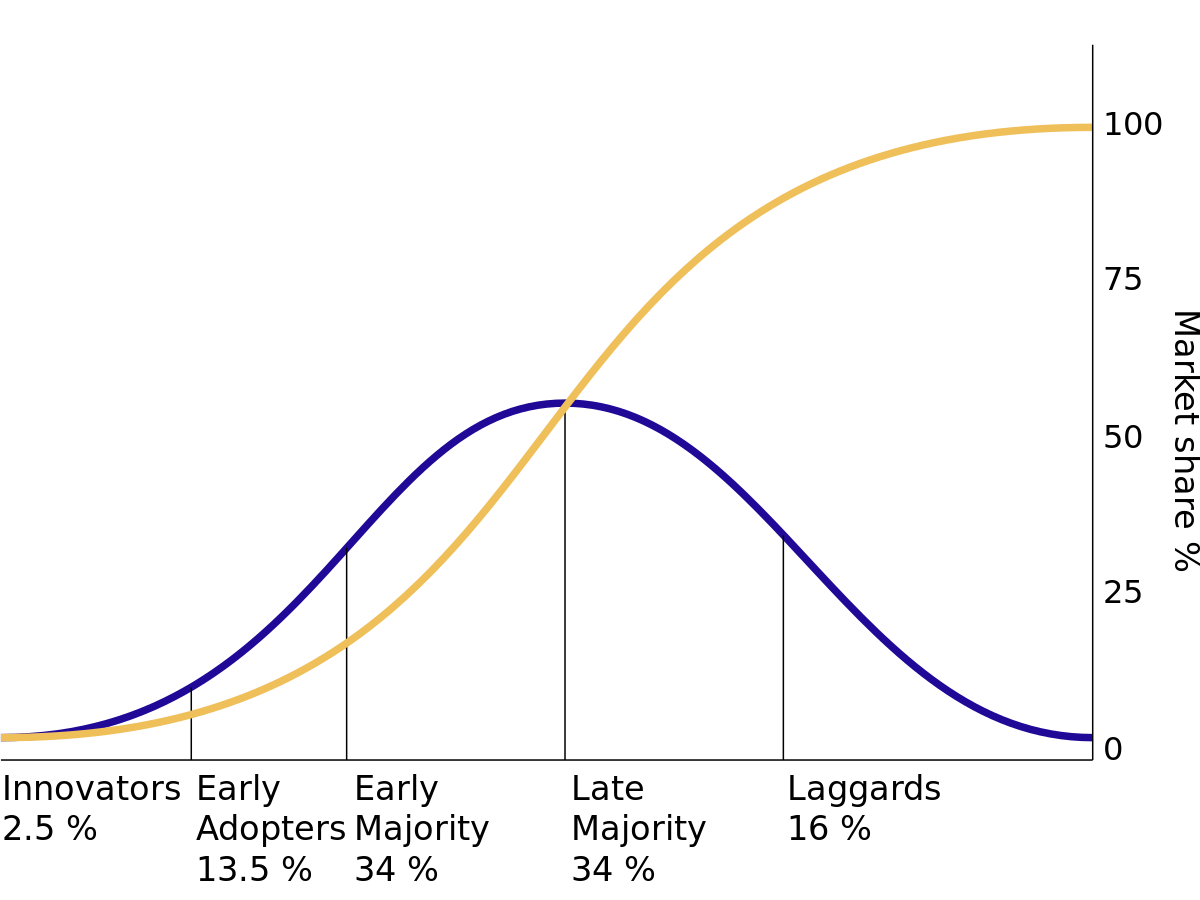

A platform is a business process framework (EOS, Agile, Six Sigma, etc.), programming language, software framework (React, Laravel, etc.), or an actual platform (AWS, Linux, Salesforce, etc.). A platform is a “thing,” often it is a product that lots of businesses use and need help understanding, planning for, implementing, operating, extending, supporting, fixing, optimizing, and upgrading. As platforms grow from ideas, startups, or small open source projects into successful, mainstream products, they have to cross what Geoffrey Moore calls “the chasm”[Moore’s idea is an elaboration of prior work by Everett Rogers. In a hilarious spat between academic and consultant, Everett Rogers, in the 5th edition of the book that Geoffrey Moore based much of his “chasm” idea on, actually added a paragraph criticizing Moore’s work, saying “Past research shows no support for this claim of a ‘chasm’ between certain adopter categories.” Quite the burn!]. Before crossing the chasm, the platform appeals to risk-tolerant innovators and early adopters, but more risk-averse mainstream and later adopters avoid the platform because it lacks the full ecosystem of support needed to successfully adopt it, including standards, best practices, competent service providers, integrations with other products, and training. Geoffrey Moore claims – and I agree – that if possible mainstream and later adopters will wait until this full ecosystem of support is present before they adopt the new platform.

I’ll explain the “pre-chasm” risk in the next section. Here we’ll focus on the “post-chasm” context. Look at Rogers’ adoption curve:

Geoffrey Moore’s chasm exists between the Early Adopters and the Early Majority. That’s the dividing line between risk-tolerant and risk-averse. This diagram is stylized, but you can see the market share curve reaches its steepest point (meaning the fastest rate of market share growth) after the platform has crossed the chasm. Several things are happening simultaneously around this point:

“Everybody” is talking about the platform

The rapid rate of market share growth the platform owner is seeing starts to feel normal to the platform owner

As a result of these two things, lots of service providers are attracted to the platform ecosystem, causing it to become filled with lots of good options for customers to choose from. As this situation continues for some years, the platform’s market share growth starts to level off. Remember this adoption curve is stylized; in reality even rapid market share growth can be interrupted by numerous little glitches and setbacks that make people freak out and react prematurely.

Platform owners react to slowing market share or revenue growth by seeking new revenue streams and seeking to commoditize their complements[https://www.gwern.net/Complement]. Auto manufacturers want the complements to cars – things like gasoline, repair services, tires, and so forth – to be broadly available at high quality and low price. Commodities, in other words. Salesforce wants the complements to their platform – things like training, consulting, implementation services, and third-party support services – to be broadly available at high quality and low price. If you provide any of those things, Salesforce wants you to be a commodity. That’s good for Salesforce, and, if you don’t know how to run a commodity business[It’s common to think that a lack of differentiation is what causes a business to produce commodities. It’s not. What enables a business to produce commodities is production model that can scale up to producing a high volume of output featuring high quality, high standardization, and pricing that the majority of a market can afford. While such products or services are often also minimally or completely undifferentiated, the lack of differentiation alone is not sufficient to make them commodities.] profitably, not good for you.

The other way that platform owners react to slowing growth is to look for new revenue streams. They might add a services division or buy an agency, the way Salesforce bought Acumen Solutions. They might weaken their brand with rent-seeking changes to pricing tiers.

If you have specialized in a platform, all of these post-chasm changes in the platform ecosystem put pressure on you to morph your business into one that operates with high efficiency so that you can be profitable within a competitive, commoditizing system. If your business started out focusing more on innovation – on “figuring shit out” – then you are facing what is in reality a very difficult and risky, if not unpalatable or impossible, transition.

This is the risk of specializing in a platform that has crossed the chasm.

5) Specializing In A Platform That Has Not Crossed The Chasm Is Also Risky#

Before a platform crosses the chasm, the platform needs people like you to help build what Geoffrey Moore calls a whole product ecosystem. The platform owner has their hands full with core product engineering and marketing work, and so if you show up and contribute expertise, consulting, thought leadership, training, or other stuff that risk-averse customers need, then the platform owner will see you as an ally and informal partner and they’ll often treat you as such. Especially if you are a first-mover, this can create a powerful tailwind that makes your platform specialization work incredibly well.

This is all great. The risk, though: you can not know with certainty whether a pre-chasm platform will make it across the chasm and into mainstream adoption, which is where the real money is for everybody. By definition you can’t be a first mover into a liquid market, so being a first mover means that you will ignore the “healthy/liquid market rule” described above.

I’ve seen a pre-chasm platform specialization work out well for some people, generating life-changing amounts of revenue for the lucky ones who bore this risk. But it is risky. Beware.

6) A Specialization That Requires You To Cultivate Deep Expertise Or Market Credibility Quickly Is Risky#

Those who buy professional services, including custom software development services, roughly fall into two categories: professional buyers, and non-professional buyers. For the former, discovering, vetting, and buying services from outside vendors is a primary job responsibility. For the latter, this work is something extra. It might be important work, but non-professional buyers approach the process with less rigor. They function as satisficers:

Satisficing is a decision-making process in which an individual makes a choice that is satisfactory rather than optimal.

Source: https://thedecisionlab.com/reference-guide/psychology/satisficing

Additionally, many of you sell expertise in not-yet-fully-mature technology. In such cases, even professional buyers may not know how to effectively vet your expertise, and they may have to rely on proxies that are more like their gut feel about things, or your larger track record outside of the expertise/technology in question.

If most of your experience selling your services/expertise has been selling to non-professional buyers or selling expertise in not-yet-fully-mature technology, then you may have adapted to selling on “easy mode”. There’s absolutely nothing wrong with this, but if you decide to specialize in one of the following, you may find yourself switching from selling on easy mode to selling on l33t mode, and that may be a difficult transition to execute:

You specialize in a more mature technology, where buyers are more rigorous or discerning in their vetting of vendors

You specialize in a way that happens to have you dealing with more professional buyers, who are automatically more rigorous in their vetting of vendors

The risk here is not the specialization per-se, but the specialization causing you to need to quickly acquire new business skills in order to effectively sell the specialization. It’s not impossible to do this (it may be an invigorating challenge for some of you!), but if you’re not prepared for the challenge or if you navigate it poorly, it can reduce the effectiveness of your new specialization.

Those are the 6 riskier forms of specialization. All of them are more about a specific context that specializing can lead you into rather than a particular way of specialization. Again, the lowest-risk context is the presence of a healthy market (liquidity + known thing being traded). Very often in business, though, exceptional profits come from risk-taking that pays off. So maybe you want to take on additional risk when you specialize? Here’s how to think about whether you have enough risk profile to do that.

How To Know If You Have Sufficient Risk Profile For A High-Risk Specialization#

Never specialize in Salesforce; it’s a high-risk specialization.

I hope the previous sentence made you laugh because you now understand that whether a specialization is low or high risk is all about the context the specialization puts you into, not the specialization itself. The context is the unique combination of your history, expertise, interests, and personality combined with the specialization you’ve chosen combined with the market conditions you face once you’ve specialized. This is why in this book I can’t say whether specialization X is too high risk for you specifically. Instead, I can give you some questions that help you reflect on what financial advisors call your risk profile, which is your emotional response to risk and volatility combined with your physical ability to withstand loss if the risk you are taking does not work out well for you.

Are you willing to use savings or credit to keep things going until your risky specialization pays off? (And do you have savings/credit to use?) How far down would you draw savings, and how much time or leverage would it buy you to do so?

Is it relatively difficult or easy for you to walk away from sunk cost? What’s the largest sunk cost you have walked away from in order to quit something that wasn’t working, pursue a better opportunity, or make yourself feel better?

@NOTE: move the inline definitions of sunk cost and other terms up from the last part of this chapter to here.

Are you able to maintain an optimistic attitude in the face of uncertainty? How stressful do you find uncertainty? How do you treat others that you care about when you are facing uncertainty about your business venture?

How do you respond to volatility that effects you? Do you extrapolate your guesses about the future from the last week, month, or year’s events? Do you have a sense for how regression towards the mean has or has not effected your life?

How do you respond to the notion of ethical bullshitting? Is this an ability that you have and have used before? Is this something you think should not be necessary for success as a specialist? (Does the very notion of ethical bullshitting make no sense to you?)

This list of questions is not like one of those “give yourself 1 point for each ‘yes’ answer and if you scored more than xx then that means…” personality tests. Rather, if you’ll immerse yourself in these questions, you’ll walk away with a felt sense of whether you’ve got the risk profile necessary for a more risky specialization. If you forced me to estimate what percentage of the human population does, I’d go with Pareto numbers and say either 20% or 4% (the upper 20% of the upper 20% in a Pareto distribution).

How To Moderate The Risk Of The More Risky Specialization Approaches#

If one of these higher-risk specialization approaches seems like the right approach for your business, you might be interested in ways to reduce the risk somewhat, or a hedge against the risk’s downside potential. Here are 3 possibilities.

1: Before specializing your entire business, you could create a product, like a book or course, that is specialized in the same way you intend to specialize your business. Your success in selling this product would be a good feedback mechanism about the market’s desire for the specialized solution you’re thinking about morphing your business into. If it sells poorly, the product does represent some sunk cost that it might be difficult to walk away from, but better to learn that your market has limited desire for the specialized solution at the scale of a small product than to learn that lesson at the scale of your entire business.

2: You could attempt to build an audience around the topic or problem that lies at the heart of your potential risky specialization. For example, if there is a groundswell of demand for some new category of specialized service, a Substack or similar newsletter focused on the new category ought to absorb some of that latent demand. If you “build it and they don’t come”, then don’t talk yourself into believing it’s because you’re a bad writer or used the wrong font for the newsletter. It’s much more likely that there’s insufficient demand for this new category that you’ve dreamed up.

3: If you have expertise (unrelated to the potential specialization) that is easy to find buyers for on short notice, this potential income stream can serve as a hedge if the risky specialization doesn’t work out. For example, maybe you can easily pick up a contract or part-time job because you have skills in a popular programming language and relevant experience. Such a hedge can allow you to pursue a more risky specialization without “betting the farm”.

How To Think About Whether A High-Risk Specialization Is Worth It For You#

Luck is a real problem when we talk about whether you should pursue a high-risk specialization because if I try to give you a decision tree or algorithm to help you decide, luck will always be a confounding factor. The winds of luck will always blow one way or another, either sharpening or dulling the precision and skill of your decisionmaking. Sometimes these winds will be gentle, and other times they will be fierce. They will always be unpredictable. I can’t advise you on whether or not to pursue a high-risk specialization, but I can help you think about whether you occupy a suitable context for such risk-taking. Consider these questions:

If the high-risk specialization didn’t work out, would you react to the sunk cost (the un-recoverable time and effort you put into it) as valuable learning or as a shameful loss or defeat? Obviously your actual reaction would be somewhere between these extremes, but which direction would you lean?

If it didn’t work out, how would you react to the opportunity cost? Let’s say you were making $150k/year at a job, quit to pursue a high-risk specialization, made $60k over the year you tried it, and gave up and went back to the $150k job. How would you react to the lost $90k and any other upsides you lost by leaving the job for a year?

If it didn’t work out, would it damage your lifestyle in a consequential way? To build on the previous example, maybe the lost $90k wouldn’t really effect your lifestyle because you live frugally, have a high-earning spouse, or other mitigating factor?

Can you (and those close to you) tolerate the emotional burden of an uncertain venture or income with high variability? Or does “uncertain venture” instead register more like “exciting opportunity/adventure”?

Finally: do you really want to? I’m less convinced than I used to be that there’s a positive correlation between increased riskiness and increased enjoyment. Maybe that’s just me aging, or maybe that’s me seeing more clearly as I age. I hope it’s the latter. But for you, do you really have an insatiable hunger for high risk-reward activities, or do you prefer situations with more predictability, even if the predictability comes at the cost of potential upside?

I’ve directly advised hundreds of people on their specialization decision. If you asked me to bet a lot of money on someone’s specialization decision, I’d bet based not on their decision itself, but on their prior track record of turning opportunity into revenue. I take the notion of regression towards the mean seriously. It takes serious skill and effort or the gale-force winds of luck to move a business away from the mean defined by its past performance. That’s why I’d bet based on past performance. And so I’ll close this section by saying that if you’re trying to decide whether to pursue a high-risk specialization, the best predictor of success is the combination of your past performance as a risk-taker and your past performance as a small business operator.